Prepare your customers for the upcoming travel season: Clearing up common travel insurance misconceptions

As the cold Saskatchewan winter approaches, many of your customers are gearing up for their annual migration south. With a large population of “snowbirds” who spend their winters in warmer climates, it’s essential to help them navigate the often-confusing world of travel insurance. This season, take the opportunity to clear up some common misconceptions and ensure your customers are fully protected while they’re away.

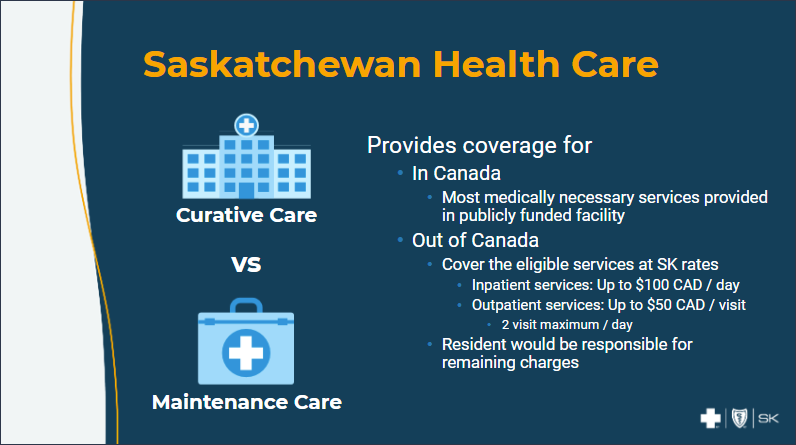

“My provincial health coverage is sufficient.”

This is a common misconception. While Saskatchewan Health offers some coverage for travel outside the province or country, it is quite limited. Hospital stays, physician services, and other medical treatments abroad can often be much more expensive than what’s covered, leaving individuals responsible for the difference. Encouraging customers to consider additional travel health insurance is a an important step to help protect them from medical emergencies and bills.

“Travel insurance only covers medical emergencies.”

Another common misconception is that travel insurance only covers medical emergencies. In reality, comprehensive travel insurance goes far beyond that. Saskatchewan Blue Cross offers a full suite of travel insurance solutions that cater to all types of travelers and travel needs. From medical emergencies to baggage protection, trip cancellation or interruption, and Top-Up coverage for additional days, we’ve got your customers covered. Explore the full range of our travel insurance options by checking out our Advisor Travel Plans Comparison Guide.

“I have travel coverage through my credit card.”

It’s true – many credit cards offer travel insurance, but how comprehensive is it? Often, this coverage is basic and may fall short in an emergency. Here are a few critical questions you should encourage your customers to ask about their credit card travel insurance:

- Are all travelers covered? Credit card travel insurance may only cover the cardholder, leaving spouses and dependents unprotected.

- How many days are covered? Coverage duration varies widely between cards. Your customers should check to ensure their trip is fully covered. If not, Saskatchewan Blue Cross offers Top-Up travel insurance that extends coverage up to 365 days.

- Is coverage comprehensive? Benefits can vary significantly. Some credit cards may only provide emergency medical coverage, while others offer limited or no protection for baggage loss or trip interruption. Remind your customers that traveling without adequate coverage—or with gaps—means they are essentially self-insuring their trip, risking significant out-of-pocket expenses.

Be prepared, not surprised.

This course provides a refresher of the upcoming travel industry, types of travelers and travel products offered by Saskatchewan Blue Cross. Upon completion of this course, learners will receive 1 Continuing Education (CE) Credit.

We hope these tips help you guide your customers through their travel insurance options, ensuring they’re ready for the upcoming season. For additional support, check out our all-inclusive Pre-Travel Checklist—a great resource to share with your customers to ensure they’re fully prepared before they hit the road. Remember, the most important thing your customers should pack is their travel insurance.